If your name is Daniel Garcia, don’t even think of applying for apartment, a job, a mortgage or a car loan. Because you’ll be denied. Thanks, apparently, to increased use of OFAC’s SDN list to scan routine domestic transactions from used car sales to lease applications.

If your name is Daniel Garcia, don’t even think of applying for apartment, a job, a mortgage or a car loan. Because you’ll be denied. Thanks, apparently, to increased use of OFAC’s SDN list to scan routine domestic transactions from used car sales to lease applications.

This is the conclusion of a report issued today by the Lawyers Committee for Civil Rights of the San Francisco Bay Area. The report trots out a half-dozen horror stories of OFAC screening gone wrong and finds:

- A couple whose mortgage application was denied simply because the husband’s middle name “Hassan” was listed on the SDN list as an alias for one of Saddam Hussein’s sons;

- A couple whose first home purchase couldn’t close because the first and last name of the husband, both common Hispanic names, matched a name on the SDN list;

- An individual who couldn’t purchase a car simply because his last name, Muhammad, caused a credit agency to report that he was a hit on the SDN list

- An individual that could not pick up $50 that had been sent to him by a money transfer service because his first and middle names were Mohammed Ali;

- A PayPal customer named Yusuf Mohammed who had his account closed; and

- A man who couldn’t buy a treadmill because his first name is Hussein.

The problem occurred in these instances for one of three reasons: (1) the company didn’t know how to properly identify a hit; (2) the company didn’t want to take time to determine if a proper hit was a false positive; or (3) even if the company was willing to take that time, the SDN entry lacked sufficient identifying information (e.g. no date or place of birth) to determine whether the hit was a false positive.

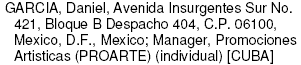

Our not-so-hypothetical SDN Daniel Garcia (not one of the Lawyer’s Committee’s examples) has a common Hispanic name and his SDN entry has no place of birth or date of birth that would allow a simple ID check to verify that the hit was a false positive. See for yourself:

Needless to say as more and more companies with less and less screening experience screen customers against the SDN list, anyone named Daniel Garcia might consider changing his name.

The Lawyer’s Committee report raises two interesting issues. First, although the real SDN has the legal right to challenge his designation, the mistaken SDN has neither the right to challenge the designation nor to obtain an official determination that he or she isn’t the real SDN. OFAC’s refusal to provide such an avenue of relief is, indeed, hard to rationalize. OFAC is giving more rights to the alleged terrorist than to an ordinary American. (Would somebody get Lou Dobbs on this?)

Second, because of the abundance of common Hispanic and Middle Eastern names on the SDN list, careless use of the list may hide unlawful discrimination in the provision of housing, credit or employment. A company that simply refuses to provide service to a hit without taking steps to verify whether the hit really is an SDN will have a hard time justifying that the SDN list was the real reason for the denial rather than an intent to discriminate based upon national origin.

Posted by

Posted by  Category:

Category:

News accounts of the circumstances surrounding the agreement of Chiquita Brands to pay a $25 million criminal fine for payments made to a rebel group in Columbia don’t really tell the whole story. That story can be found in the

News accounts of the circumstances surrounding the agreement of Chiquita Brands to pay a $25 million criminal fine for payments made to a rebel group in Columbia don’t really tell the whole story. That story can be found in the The Office of Foreign Assets Control (“OFAC”)

The Office of Foreign Assets Control (“OFAC”)  The

The  According to

According to